What Is Care First Blue Croos Blue Shield Plan G

With 36 independent and locally operated companies, Blue Cross Blue Shield provides health insurance coverage in all 50 states. In fact, it covers one in three Americans, making it one of the largest health care insurance providers in the nation. In addition to the Blue Cross Blue Shield name, coverage is offered under such brand names as Anthem, CareFirst, Highmark and Regence.1

Most companies under the Blue Cross Blue Shield umbrella are rated "A" by AM Best, which issues a financial strength rating for companies. Although this rating is not a guarantee of how Blue Cross Blue Shield will deliver on its insurance products, it is a good indicator of a strong performance.

What Features Do Blue Cross Blue Shield Medicare Supplement Plans Offer?

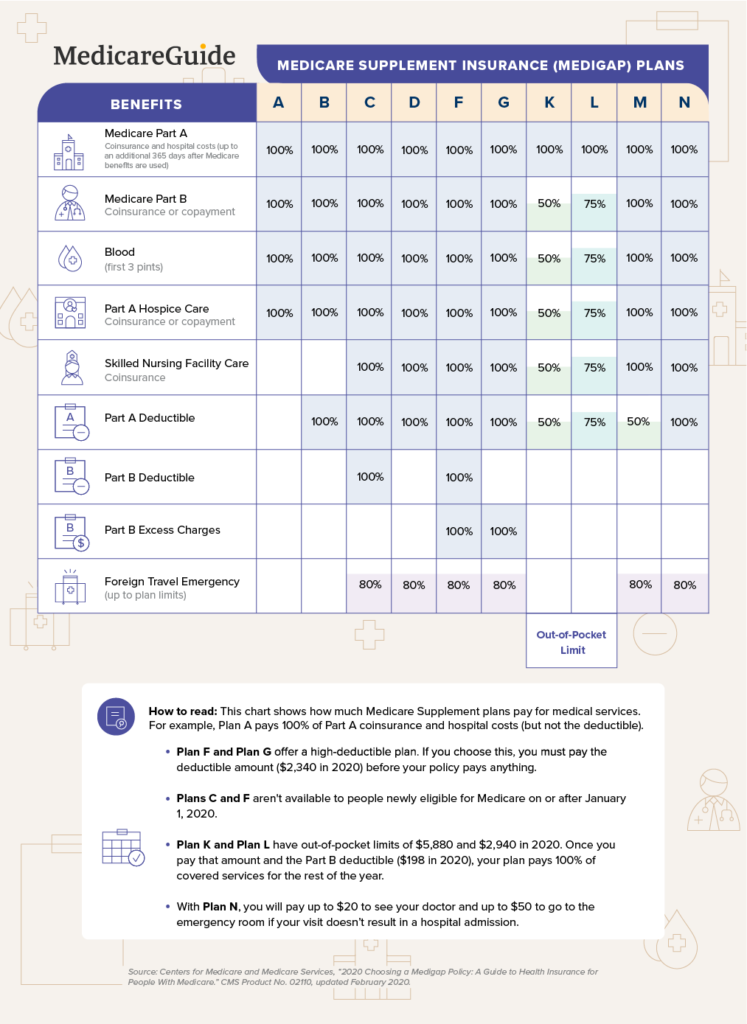

Blue Cross Blue Shield Medicare Supplement plans, also known as Medigap, help cover medical costs not covered by Medicare Part A and Part B (Original Medicare). These include such out-of-pocket expenses as deductibles, copays and coinsurance. The government mandates that all Medigap policies provide the same coverage, but private insurance companies can charge different rates for these policies.2

Although Blue Cross Blue Shield sells Medigap plans nationwide, not every plan may be available in your area. Regardless, all Medigap policies are accepted anywhere Medicare is accepted, so there are little to no limitations on coverage networks.3

What Kind of Medicare Supplement Plans Does Blue Cross Blue Shield Offer?

Blue Cross Blue Shield offers 10 Medigap policies that vary based on premium costs and coverage. These are:

Plan A

Medicare Supplement Plan A covers all Medicare Part A coinsurance and hospital costs for a maximum of 365 days after regular Medicare benefits are maxed out. It also covers the coinsurance and copay for Part A hospice care as well as Medicare Part B coinsurance or copay.4

Plan B

Medicare Supplement Plan B offers the same coverage as Plan A plus your Medicare Part A deductible.5

Plan C

Medicare Supplement Plan C covers the same as Plan B as well as your Medicare Part B deductible and coinsurance for skilled nursing facility care. In addition, it will pay 80% of your plan's limits for foreign travel emergency costs.6

Plan D

Medicare Supplement Plan D offers the same coverage as Plan C except for your Medicare Part B deductible.7

Plan F

The most comprehensive supplement plan, Medicare Supplement Plan F offers the same coverage as Plan C plus Medicare Part B excess charges. There's also a high-deductible plan, HD-F, in which you have to pay Medicare-covered costs up to the deductible amount of $2,340 for 2020 before the supplement plan pays for any costs.8

Plan G

Medicare Supplement Plan G offers the same coverage as Plan F except it does not pay the Medicare Part B deductible. It also has a high-deductible version, HD-G, that operates the same as HD-F.9

Plan K

Medicare Supplement Plan K pays all Medicare Part A coinsurance and hospital costs for a maximum of 365 days after regular Medicare benefits are maxed out. It also pays 50% of the following: Medicare Part A deductible, Part A hospice care coinsurance or copay, Medicare Part B coinsurance or copay, and coinsurance for skilled nursing facility care. Once you meet your out-of-pocket yearly limit and your annual Part B deductible, the plan pays 100% instead of 50%.10

Plan L

Medicare Supplement Plan L covers the same costs as Plan K, but pays 75% of the listed costs instead of 50%. Likewise, once your annual out-of-pocket limit and Part B deductible are met, it will pay 100%.11

Plan M

Medicare Supplement Plan M offers the same coverage as Plan D, except instead of paying 100% of your Medicare Part A deductible, it only pays 50%.12

Plan N

Medicare Supplement Plan N offers the same coverage as Plan D with one notable exception. While it pays 100% of the Part B coinsurance, you may have to pay a copay of up to $20 for some office visits and a maximum of $50 copay for emergency room visits that don't lead to an inpatient admission.13

Following a change effective January 1, 2020, Medigap policies are no longer allowed to cover the Part B deductible for new Medicare members. Therefore, Plans C and F are not available to new members unless you were eligible for Medicare prior to January 1, 2020, but have yet to enroll.14

Remember that not all plans are available in all areas of the country.

A Word of Advice

Research what plans are available to you in your area. Also, get a personalized quote to see which one will providethe most value for you.

How Much Do the Most Popular Supplement Plans Cost with Blue Cross Blue Shield?

Rates for Medicare Supplement plans vary based on a number of factors, including age, gender, ZIP code and tobacco use, so it's important to get your own individual quote. A 65-year-old woman living in Los Angeles, Ca. would pay a monthly premium for the following plans:

- Plan F: $174

- Plan G: $138

- Plan N: $136

What Kind of Medicare Advantage Plans Does Blue Cross Blue Shield Offer?

Blue Cross Blue Shield also offers Medicare Advantage, or Medicare Part C, plans that cover all expenses not fully covered by Original Medicare. They may include additional coverage such as vision services, hearing aids and wellness programs. Costs and coverage options vary by area. Medicare Advantage plans cover specific geographic areas, and have more limited provider networks. They're different from Medigap policies. If you purchase a Medicare Advantage plan, you can't purchase a Medicare Supplement plan.15

Next Steps

Blue Cross Blue Shield Medicare Supplement Plans can be a valuable way to pay for any expenses not covered by Original Medicare. However, it's important to research what plans are available to you in your area and get a personalized quote to determine which plan will provide the most value for you.

The views and opinions expressed are those of the authors and do not necessarily reflect the official policy or position of MedicareGuide.com or HealthCare, Inc.

gardnerblecliked70.blogspot.com

Source: https://medicareguide.com/bcbs-medicare-supplement-review-252219

0 Response to "What Is Care First Blue Croos Blue Shield Plan G"

Post a Comment